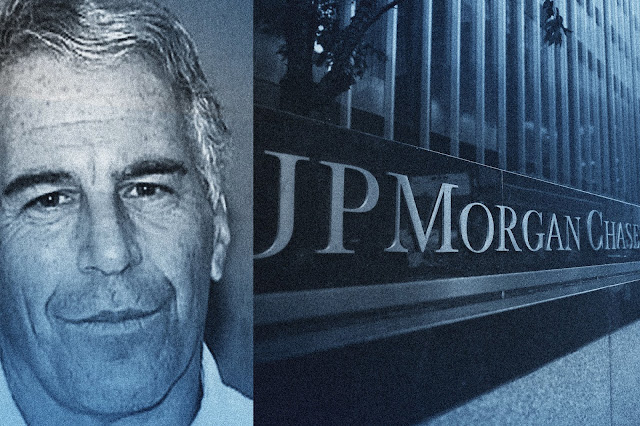

Internal records and recent court filings show that JPMorgan allowed Jeffrey Epstein to maintain high-volume accounts and processed over $1 billion in suspicious transactions. The issue goes beyond one client - it strikes at how global banks manage risk when big money meets scandal.

Epstein was a client of JPMorgan from 1998 until 2013.

-

In 2006, JPMorgan flagged Epstein’s repeated cash withdrawals of $40,000-$80,000 several times per month.

-

As of 2022/2023 lawsuits, JPMorgan was alleged to have reported more than $1 billion in suspicious transactions connected to Epstein to the U.S. Treasury, but only after Epstein’s 2019 death.

-

Internal emails show senior bank executives were aware of the risk at minimum by 2008, yet the relationship persisted.

Analysis

What most people are missing:

-

This story isn’t only about a bank’s bad client - it’s about how elite banks weigh revenue-versus-risk when a client is extremely lucrative. Epstein was among JPMorgan’s top revenue generators.

-

The case uncovers process vulnerability: bank compliance flagged the red-flags (cash withdrawals, recruiter payments, known associations), but escalation to senior decision-makers was weak or delayed.

-

The reputational risk now converts into regulatory and legal risk. If banks with global reach cannot enforce their AML (KYC) protocols consistently, the broader system’s trust is weakened.

-

For emerging markets (like Nigeria) and outsourcing of financial operations, the lesson is clear: global banks under-investing in compliance oversight create contagion risk for their partners and downstream ecosystems.

Implications

-

For global banking / finance: Large banks must re-examine how they treat “whale” clients whose attractiveness may overshadow risk triggers. Regulators will hold not just front-line compliance but senior executives accountable.

-

For clients and service providers: